Beyond Speed: The Transformative Potential of Instant FinalityBeyond Speed: The Transformative Potential of Instant FinalityBeyond Speed: The Transformative Potential of Instant Finality

With eCash’s long-awaited Pre-consensus upgrade entering its latest stages, the promise of instant transaction finality will become reality soon™. But the implications of this reality go far beyond quick transaction speeds and removing waiting time for exchange deposits. So what is instant finality on eCash and why is it such a big innovation?

What’s Instant Finality?

Instant finality means a transaction is settled and irreversible immediately, eliminating the need to wait for confirmations or worry about reversals. On eCash, this leap is achieved through Avalanche consensus, a protocol layer integrated with eCash’s core proof-of-work technology that allows nodes to quickly agree on the order and validity of transactions before they are included in a block.

This Nakamoto/Avalanche hybrid approach ensures transaction finality is not only immediate but also robust. Transactions become final within a time frame of 2 seconds without sacrificing decentralization or resilience, making eCash among the most secure and fastest cryptocurrencies to date while remaining a trustless blockchain. This sets it apart from solutions that trade security for speed or depend on overly complex or trusted setups like delegated proof-of-stake representatives, masternodes, or intermediaries.

TPS and Transaction Finality

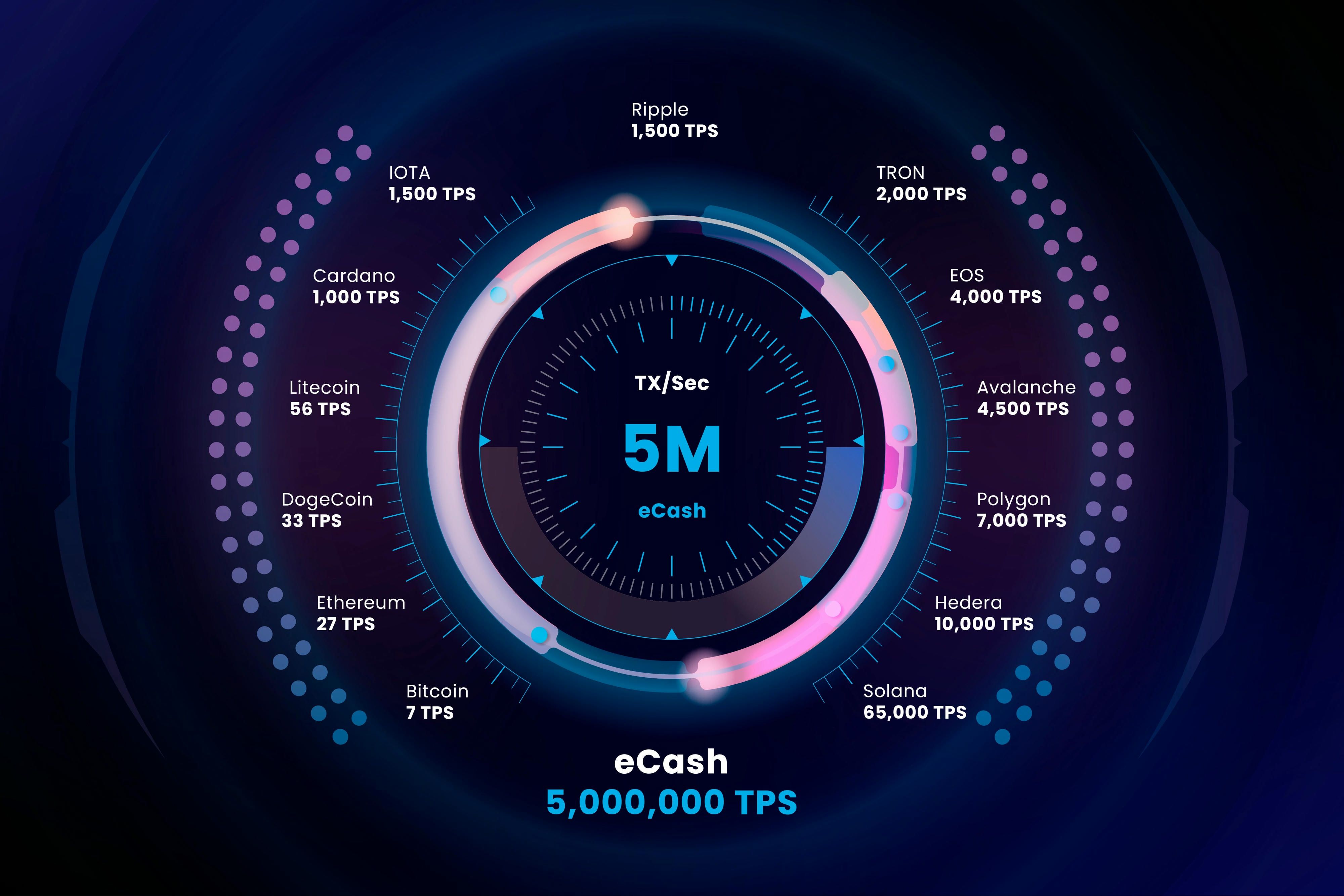

Powering the digital economy of tomorrow requires more than just high Transactions Per Second (TPS). While eCash’s 5 million TPS target is an impressive throughput capacity, the true bottleneck for a payments network is actually how quickly transactions are finalized and irreversible. In a global digital economy, being able to process a large amount of transactions is not enough if each one takes minutes to be truly settled.

Bitcoin and cryptocurrencies are already much faster compared to legacy banking and payments regarding settlement times but Pre-consensus on eCash delivers industry-leading transaction finality measured in seconds, not minutes. Competing solutions may promise fast settlement in optimal conditions, but often fail to deliver consistent results in real-world scenarios and require significant trade-offs in simplicity, decentralization, or reliability. On eCash, transaction finality takes in most cases less than 3 seconds, and incorporates mechanisms to gracefully handle adversarial conditions. This makes the network uniquely equipped to serve as the backbone for real-world digital economies where censorship-resistance, scale, utility, speed, and security all matter.

History of Settlement Risk

To understand why this is transformative, it helps to look at the history of money and payments. For example, precious metals like gold needed banks and clearinghouses in scaled economies to move value efficiently across distances and between parties. To take a more modern example, credit card payments seem instant to users at the point of sale but actually rely on a maze of banks and payment processors who provide upfront liquidity while true settlement takes days or weeks. Of course, this comes with each intermediary taking a sizable cut for the service provided. Even stock trades often take two days to fully settle. During this window, buyers and sellers are exposed to counterparty risk and market fluctuations, hence the need for clearing firms as intermediaries. Similar issues stemming from the same root issue of liquidity can be seen with remittances and escrow services as well. In other words, all market economies around the globe are built around mitigating settlement risk, which has been a constant factor in the history of civilization. Until now.

Enabling New Use Cases

While instant transaction finality constitutes a significant speed improvement for eCash, the real breakthrough is how it fundamentally transforms the underlying trust model. Each of the examples above shows how intermediaries arose to solve the problem of settlement risk by providing trust, liquidity, and guarantees where instant settlement was impossible. With eCash’s instant finality, settlement risk is removed and value can move directly between parties without delay or reliance on costly middlemen. This transformation allows for microtransactions, enables real-time automation, and reduces cost and overhead for global commerce, allowing entirely new business models that depend on immediate certainty.

Streaming payments become feasible, letting users pay for music, bandwidth, or API usage by the second with each microtransaction settled in real time. Devices can independently buy and sell energy, data, or logistics services without human intervention. AI agents could pay each other to delegate sub-tasks, allowing extended cooperation and specialization. In gaming, tokenized assets and rewards can be transferred instantly, enabling seamless blockchain-powered economies within games. Atomic swaps and complex multi-party trades can happen directly between participants without intermediaries or escrow. In insurance, lending, and derivatives, payouts or margin calls can be executed the moment conditions are met. Digital services gain flexibility as access can be granted or revoked instantly based on payment status.

Fast and reliable finality is especially critical for advanced applications like decentralized finance, real-time supply chain tracking, or automated contracts. Without immediate certainty of settlement, these systems remain vulnerable to disputes, delays, or manipulation—limiting their usefulness and scalability. Instant finality on eCash removes these barriers and lays the groundwork for truly global, automated commerce.

Cross-Chain Functionality and Subnets

The Pre-Consensus upgrade is also a prerequisite for eCash subnets and interoperability. In a networked world where assets, data, or smart contracts move between different blockchains, sidechains, and subnets, instant finality provides the certainty that allows atomic swaps and cross-chain trades to happen safely, as both parties can verify that their side of the deal is finalized before releasing assets. Cross-chain applications and protocols can execute complex logic with confidence, knowing the underlying token and smart contract transactions are permanent, preventing double-spending and other exploits.

Without this guarantee, such operations would require long waiting periods or reliance on trusted third parties, which undermines the whole point of decentralized finance and makes for limited or non-existent interoperability. With instant finality on eCash, seamless and secure cross-chain activity becomes possible at record speeds, opening up new possibilities for interconnected digital economies in the DeFi space as well. It is a prime example of how eCash optimizes Bitcoin technology for scale and utility, as one of the biggest drawbacks of BTC is its incompatibility with the wider DeFi sector and its reliance on trusted intermediaries to access even its own second layers.

Conclusion

The core breakthrough of Bitcoin was removing trusted third parties in digital payments from the equation. Instant finality takes this innovation further by enabling value to move directly between users with a level of certainty and speed unmatched by legacy financial systems or state-of-the-art cryptocurrency projects. Achieving instant finality on the trustless eCash network is not just about faster exchange deposits or improving scalability through real-time processing—it unlocks the next generation of financial applications with true atomic settlement at internet speed. This is a foundational leap both for blockchain and current payment technology as it fundamentally changes how value moves in the digital world, removing settlement risk and the costly intermediaries that come with it.